A relatively small amount of force applied at just the right place

Explaining Y Combinator

If you enjoyed this, subscribe below. You might like this review of Tyler Cowen and Emergent Ventures for more on this topic.

There are thousands of smart people who could start companies and don't, and with a relatively small amount of force applied at just the right place, we can spring on the world a stream of new startups that might otherwise not have existed. [Paul Graham, Why YC]

Paul Graham wrote this in 2006, just one year after co-founding the startup accelerator, Y Combinator (YC). And in his most recent essay, “How to Do Great Work,” he broadens the claim: “Many more people could try to do great work than do.”

Paul Graham often analogizes starting a startup to a kind of “economic research.” Taken literally, YC is one of the most remarkable breeding grounds for invention in history. If Bell Labs’ scientists invented the transistor, the laser, Unix, information theory, etc, then YC’s “economic research scientists” invented OpenAI, Stripe, AirBnB, Instacart, Doordash, Dropbox, Reddit, and many more.

But what is the key to unlocking the impact of YC, in any field? What was this “relatively small amount of force applied in just the right place”? This question has kept me thinking for years.

I’m obsessed with the question of how to increase the rate of company creation in biotech. The U.S. produces thousands of life science PhDs each year, and spends billions in federal research funding, yet only a few hundred biotechs are formed and funded each year. The number could be so much higher. So how do we increase it? By studying the history of institutions like YC, we can learn how to unleash such a force in other fields.

It is way too easy to credit YC’s success to its obvious peculiarities – the application, the batches, demo day, etc. That experiment has been run. Many times. Just two years after its launch, YC had so many copycats that Y2 Combinator appeared to mock them [1]. One copycat even duplicated the YC application, word-for-word.

But you’ve probably never heard of any of them, because they missed the point.

This essay has sat in my files as a loose connection of notes on YC for over a year now. I could never quite figure out the answer. I read all of Paul Graham’s and Jessica Livingston’s essays, even every comment Paul ever wrote on Hacker News (up to 2010). I read The Launch Pad. I read all the essays from, or interviews with, YC founders that I could find. Still, it eluded me.

In reading Paul’s most recent essay, How to Do Great Work, I had a realization. YC’s “relatively small amount of force applied at just the right place,” was a discovery about who could do great work, how to find them, and how to massively raise their ambition.

This is not a study of what YC is today (2023), most people are already familiar with it and it is analyzed well elsewhere [2]. This is about how it came to be. To understand YC, we must study its early years.

Eric Gilliam wrote a fantastic accompanying piece about applying the lessons of YC to a new model for Deep Tech investing. If you don’t already read Freak Takes, I also highly recommend his study of Warren Weaver and how he cultivated the field of molecular biology.

Finding people who can do great work

1. YC tested a specific thesis that young, inexperienced founders could build great startups

Paul Graham, Jessica Livingston, Robert Morris, and Trevor Blackwell started YC with a very specific thesis: young, inexperienced founders could build great startups.

They knew this because they themselves had done it. Paul, Robert, and Trevor previously co-founded a company while Robert and Trevor were still in grad school that sold to Yahoo for $49M. But, in the subsequent seven years, Paul formulated a general theory to explain why: the cost of starting a company had fallen to the point where anyone could do it.

First, the cost of computer and server hardware had fallen rapidly.

Second, the internet made free word-of-mouth promotion extremely effective. You used to have to buy advertising or use a PR firm, but now word-of-mouth could scale awareness exponentially, for free, if you built something that users love.

Third, programmers became much more productive as programming languages became more advanced, so products could be built with fewer employees. Indeed, in How to Start a Startup, Paul Graham says “I think hiring people is the worst thing a company can do.” Since the cost of starting a company is mostly paying the people to build the product, you could get started with no capital other than the living expenses of the founders.

A corollary to this third point is that, if the company needed to hire and manage fewer people, founders could be inexperienced in management (even more so if the product was pure software).

So if anyone could do it, who should try their hand? Inexperienced, yet smart, determined, and energetic hackers [3].

The most interesting subset may be those in their early twenties. I'm not so excited about founders who have everything investors want except intelligence, or everything except energy. The most promising group to be liberated by the new, lower threshold are those who have everything investors want except experience.[Paul Graham, How to start a startup]

We’re testing a theory that technology is enabling a new model to evolve where founders of startups can be a lot younger than they used to be. As the age of startup founders creeps downward, we foresee an alternative path for the smartest and most ambitious: instead of going to work for Microsoft, they start a startup and make Microsoft buy it to get them. [Jessica Livingston, Y Combinator When No One Cared]

At the time YC started in 2005, there simply were not many opportunities for inexperienced founders in their 20s to be taken seriously by VCs, or to work with a revered figure like Paul Graham. Instead, people the age of students were treated like, well, students.

YC created the first home for them.

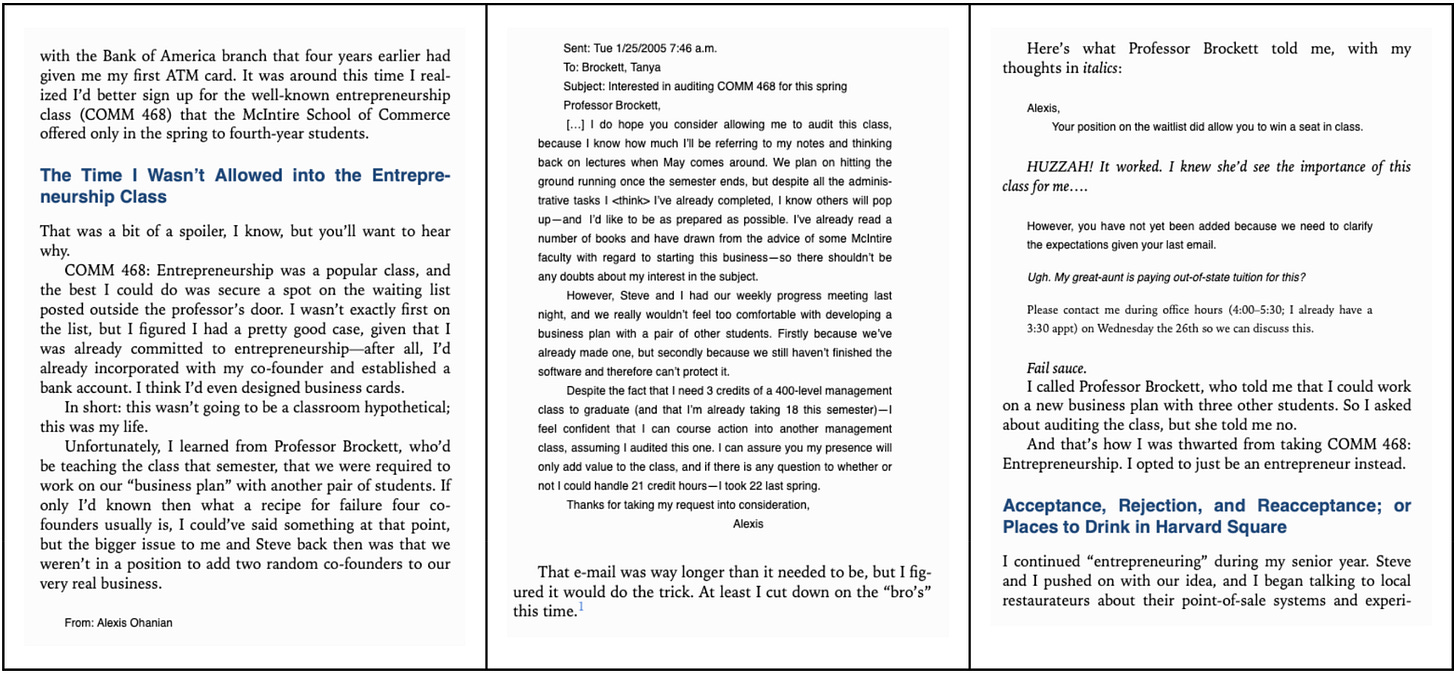

Consider Alexis Ohanian’s experience, described in Without Their Permission. He was denied a spot in his college entrepreneurship class when he refused to arbitrarily add two fake co-founders to his very real startup to satisfy the professor’s requirement to work in groups of four. When announcing YC, Paul even had to clarify that “this is not a contest. This is actual venture funding…unlike the MIT Entrepreneurship Competition, for example.”

Therefore the goal of YC would be to get young founders started. As Paul writes in Startup = Growth, all one would need to do is get something – anything really – growing at 5-7% per week. If you do that successfully, it doesn’t matter that you aren’t a fancy executive, that you aren’t plugged into the network, or that you work from an apartment rather than an office. All that matters is, how fast is it growing?

Understanding growth is what starting a startup consists of. What you're really doing (and to the dismay of some observers, all you're really doing) when you start a startup is committing to solve a harder type of problem than ordinary businesses do. You're committing to search for one of the rare ideas that generates rapid growth. Because these ideas are so valuable, finding one is hard [Note: YC itself is such an idea]. The startup is the embodiment of your discoveries so far. Starting a startup is thus very much like deciding to be a research scientist: you're not committing to solve any specific problem; you don't know for sure which problems are soluble; but you're committing to try to discover something no one knew before. A startup founder is in effect an economic research scientist. Most don't discover anything that remarkable, but some discover relativity.

The cost of launching would just be the living expenses of the founders. The time that it would take to build something, launch it, and see it start growing could be only weeks.

Therefore one could summarize YC’s structure as:

Invest in young, smart, energetic, and determined hackers

Give them enough money to pay for living expenses, but not much more

Give them a few months to build something, launch it, and see some evidence of growth

And, since finding good ideas is hard, get statistics on your side by batch processing startups – run as many of these experiments as you can in parallel.

2. Paul Graham’s writing reached the right audience

The following spring, lightning struck. I was invited to give a talk at a Lisp conference, so I gave one about how we'd used Lisp at Viaweb. Afterward I put a postscript file of this talk online, on paulgraham.com, which I'd created years before using Viaweb but had never used for anything. In one day it got 30,000 page views. What on earth had happened? The referring urls showed that someone had posted it on Slashdot. [Paul Graham, What I Worked On]

In 2005, if you were a young hacker, bored in college, you probably spent your free time reading Slashdot or other internet forums.

From 2001 up to announcing YC in 2005, Paul Graham published 31 essays about life, programming, and startups, like Why Nerds are Unpopular (2003) and Hackers and Painters (2003).

His writing found incredible traction on social news sites like Slashdot, and hacker forums like the lightweight languages mailing list. But to say they were popular is an understatement. The essays gave hackers a vision of their true potential, if they could free themselves from their pointy haired bosses. Paul became “the leading apostle, to not say messiah, of the startup gospel.” [Antonio García Martínez, Chaos Monkeys].

By 2005, a talk from Paul would fill an auditorium beyond standing room capacity. In his book Without Their Permission, Reddit founder Alexis Ohanian describes a pilgrimage from Virginia with his co-founder Steve Huffman to see Paul speak at Harvard.

The lecture room was packed, and Paul read from his notes for about forty-five minutes and graciously answered questions. At one moment he described the perfect angel investors as "people who themselves got rich from technology." As he said this, he must've noticed the roomful of aspiring founders all widen their eyes with hopefulness. He abruptly clarified: "Oh, not me!"

The rumble of one hundred simultaneously disappointed nerds echoed through the room….Graham would look back on this moment as the instant he realized a little money could go a long way for the right founders.

The “rumble of one hundred simultaneously disappointed nerds…,” was the sound of market pull for what would become YC. Indeed, only a few weeks later, in March 2005, Paul announced YC on his website. (That same month, he published 5 essays, notably A Unified Theory of VC Suckage and How to Start a Startup.)

Let’s review how it worked out. Here is the first batch in summer 2005, including where some of the founders came from, how they heard about the program, and their outcomes.

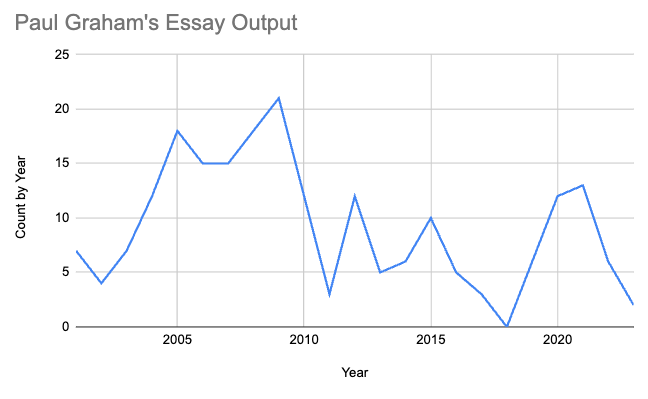

Amazingly, even while running YC, Paul kept up writing at an incredible pace, publishing multiple essays per month at his peak.

3. Hacker News transformed the essay readership into a community and culture

What would happen after someone read one of Paul’s essays on Slashdot? They would return to Slashdot to read the comments, of course. So, Paul and the YC team went a step further – why only produce essays when you could create the whole platform and resulting community itself?

YC launched Hacker News (originally called “Y Combinator Startup News”) in February 2007. The stated goal was to identify future founders by the “smart things…they’ve written.” Hacker News went on to become one of the most popular websites in tech [4].

We know some of the people who apply to us for funding—either because they're friends of people we funded, or because we met them at events like startup school—but most of the people who apply to us, we know nothing about.

That's a problem for both sides. The applicants we don't know are at a disadvantage. And it makes judging applications more difficult for us; all we have to go on is a few answers on an application form. So our hope is that by creating a community at news.ycombinator, we'll be able to get to know would-be founders before they apply to us.

You can tell a lot about the users of a site like this from the links they post and their comments in discussions. There are a number of Reddit users that I know only by their usernames, but I know must be smart from the things they've written. We're counting on the same phenomenon to help us decide who to fund.

In our new online application form (coming soon), you literally apply through your Y Combinator account, so we'll recognize usernames that have been thoughtful contributors to the site. I'm not saying we'll simply fund whoever has the most karma; that would just encourage abuses. But we will be more likely to fund people we know are smart from their submissions and comments.

This goal was a definite success. One high profile YC founder noted to me that they “posted a few blog posts that ranked very high on Hacker News. pg reached out, invited me to a YC dinner...It was pretty much inevitable that I'd end up going through YC.” Even as late as 2018, Paul found repl.it on Hacker News and had them join the W18 batch, after they had been initially rejected (source).

But Hacker News became so much more than that. It became a community and a culture, rooted in YC and Paul’s essays, allowing the growing community around YC, and the readership of the essays, to all interact – launching companies and products, finding teammates, or talking about tech news, or just about life.

For example, right after the launch of Hacker News, this post appeared on the front page [5]:

Or, here is Brian Armstrong of Coinbase in 2012 using a Hacker News post to recruit a co-founder.

Once the YC network became large enough, they also created a private social platform called Bookface. There, behind closed doors, YC founders also offer introductions, contribute advice, rate experience with VCs, and much more. I don’t review it in detail here, as the focus on this essay is on the earlier years. However, it has certainly played a very large role in YC’s continued success. In fact, several founders I’ve interviewed described as the most valuable part of YC.

4. The YC community created a talent flywheel

YC scaled really fast, backing ~60 companies across ~5 batches. With at least a few startups from each batch rapidly growing, and YC itself rapidly growing, the total talent network around YC grew exponentially.

Many famous YC companies came from YC founders’ friends and early employees.

Dropbox (W07). Adam Smith founded Xobni in the S06 batch. At MIT’s Phi Delta Theta fraternity, Adam was Dropbox founder Drew Houston’s “Big Brother,” and invited him to a YC dinner. (Source)

AirBnb (W09). Justin.tv CEO Michael Seibel became an advisor to Airbnb after meeting the founders at South x Southwest, and later suggested they apply to YC. Brian Chesky actually rejected this idea because they had already launched, but eventually they agreed as they were running out of money. (Source)

Coinbase (S12). Brian Armstrong was an early AirBnb hire, where he architected the payments platform and fraud detection system. (Source)

Cruise (W14). Kyle Vogt left MIT during his junior year to join Justin.tv after Justin Kan and Emmett Shear sent an email to an MIT engineering listserv looking for a “hardware hacker” for an unspecified project. Vogt and Justin Kan’s younger brother, Dan Kan, later co-founded Cruise in 2014. (Source)

Despite Paul Graham’s assertion that startups should not co-locate, many of the YC startups of this period did live together (and still do today) [6]. This created a social community around YC startups that also attracted new recruits, such as Justin Kan’s brother, Dan Kan, who went on to found Exec (W12) and Cruise (W14).

For example, Taylor Street in San Francisco housed the “Y Scraper,” a twelve-story building that was one of the only places in the city that offered furnished apartments on a month to-month basis. According to The Launch Pad (2012), thirteen YC-funded startups were working from this building, including Justin.tv (W07), Weebly (W07), Dropbox (S07), Xobni (S06), and Scribd (S06).

It is a testament to the YC team’s ability to pick talent, as well as their confidence in young founders, that they often backed the same founders multiple times, with even more successful outcomes coming in their later startups.

Two of the most prominent examples:

I. Kiko (S05) leads to Justin.tv leads to SocialCam (W12) and Twitch (W07)

Justin Kan and Emmett Shear started a web calendar app, called Kiko, as a part of the first YC batch S05. Google soon launched Google Calendar, putting an end to their ambitions. They sold the source code for Kiko on eBay for $258,100.

Still hanging around YC in 2006, they came up with the idea to livestream their startup strategy discussions. This ultimately led to Justin.tv (W07), a continuous live video feed of Justin’s life. YC backed them again (though they did not formally belong to a batch). Justin.tv later split into SocialCam, which sold for $60M, and Twitch, which sold for $970M. [The Launchpad].

Justin Kan also went on to start more companies, including Exec (W11) and Atrium (W18), both of which received investment from YC. He co-founded Exec with his brother, Dan. After shutting down the company in 2018, Dan Kan and Kyle Vogt (of Twitch) started Cruise (W14), now one of the highest valued on the Top 100 companies.

Tracing Justin and Emmett’s impact even further – they recruited Michael Seibel to Justin.tv. Michael later recruited Airbnb to YC, and Airbnb alumnus Brian Armstrong then created Coinbase. Michael also became president of the core YC accelerator in 2016. Justin and Emmett also both became YC Partners and probably recruited countless other YC startups.

If you followed just the direct network seeded by Justin and Emmett (“the Kikos”), you would get Twitch, Cruise, AirBnB, and Coinbase.

II. Auctomatic (W07) leads to Stripe (S09)

As mentioned earlier, Paul first met Patrick Collison while he was in high school when he emailed him questions about Lisp, probably around 2005.

In 2007, Patrick and his brother, John, joined YC to do their first startup. They merged companies with Harj and Kulveer Taggar to create Auctomatic. 10 months later, they sold Auctomatic to Live Current Media for $5M.

In 2009, Patrick and John spent the summer in Palo Alto and started working on Stripe. Interestingly, Stripe actually didn’t go through the YC program. Instead, Paul Graham and Sam Altman (one of Sequoia’s first scouts) each invested $15k for 2% of the company. [The Power Law].

Considering they had sold their previous company for $5M, the Collison brothers certainly didn’t need the money, indicating the enormous amount of value that the Collisons placed in getting to work with the YC team again (see comments from Patrick on working with Paul below).

Stripe went on to become one of the highest privately valued startups in history.

If you enjoyed this, subscribe below. You might like this review of Tyler Cowen and Emergent Ventures for more on this topic.

Cultivating ambition

The core thesis was right. YC made a bet on people overlooked because of their age and lack of experience, and the results were incredible.

Therefore, was YC’s success just a matter of selection? Would these people have been successful anyway, and YC just happened to be the first to realize it and invest? Not according to Brian Chesky of AirBnB [7]:

“When we entered YC, it wasn’t at all clear that we would exist after it,” Chesky said. “And by the end it was: ‘Can we be the next marketplace, the next eBay?” [The New Yorker]

YC raised founders’ ambitions. In Paul’s words:

Optimism and ambition are two of the main things YC cultivates in the startups it funds. You have to do it well. You can't just say "think big!" and expect that to work. But doing this effectively is a big part of the value of YC. [Paul Graham, Twitter]

How did they do it so effectively? He gives us some hints, continuing the earlier quote from How to Do Great Work:

Many more people could try to do great work than do. What holds them back is a combination of modesty and fear. It seems presumptuous to try to be Newton or Shakespeare. It also seems hard; surely if you tried something like that, you'd fail. Presumably the calculation is rarely explicit. Few people consciously decide not to try to do great work. But that's what's going on subconsciously; they shy away from the question.

So I'm going to pull a sneaky trick on you. Do you want to do great work, or not? Now you have to decide consciously. Sorry about that. I wouldn't have done it to a general audience. But we already know you're interested.

Don't worry about being presumptuous. You don't have to tell anyone. And if it's too hard and you fail, so what? Lots of people have worse problems than that. In fact you'll be lucky if it's the worst problem you have.

Yes, you'll have to work hard. But again, lots of people have to work hard. And if you're working on something you find very interesting, which you necessarily will if you're on the right path, the work will probably feel less burdensome than a lot of your peers'.

The discoveries are out there, waiting to be made. Why not by you?

YC, both incidentally and by design, forces the conscious choice to do great work, and helps founders overcome the combination of modesty and fear that often hold people back.

1. “PG and Jessica – there was no other magic trick.”

Sam Altman, a founder in the first YC batch who later also became President, wrote that “the entire secret to YC getting going was PG and Jessica—there was no other magic trick.”

A few times a year, I end up in a conversation at a party where someone tells a story about how much PG changed their life—people speak with more gratitude than they do towards pretty much anyone else. Then everyone else agrees… Jessica still sadly doesn’t get nearly the same degree of public credit, but the people who were around the early days of YC know the real story.

What did they do? They took bets on unknown people and believed in them more than anyone had before. They set strong norms and fought back hard against bad behavior towards YC founders. They trusted their own convictions, were willing to do things their way, and were willing to be disliked by the existing power structures. They focused on the most important things, they worked hard, and they spent a huge amount of time 1:1 with people. They understood the value of community and long-term orientation. When YC was very small, it felt like a family. [Sam Altman, PG and Jessica]

I believe the key point is: “believed in them more than anyone had before.”

In service of cultivating ambition, consider how impactful it must be to have a legendary hacker, founder, and investor believe in you, spend “a huge amount of time 1:1,” and put their own money behind you (YC did not raise any outside money until 2009).

This echoes a comment from Tyler Cowen on what makes Emergent Ventures so effective, which I reviewed here:

Supplying people, especially younger people, visions of what they could be, is greatly undersupplied... In some of the grants I’ve given out through Emergent Ventures to younger people, I’ve also tried to give them a sense of what I think they could be and I suspect that’s more important in some cases than the grant. In a way it’s complemented by the grant. In a way you’re giving the grant so you can package it with this vision…and the grant makes the vision more vivid or more focal, like they believe the vision because you spent real dollars on them. [Tyler Cowen, via The Tim Ferriss Show: Tyler Cowen]

2. Paul Graham is a genius at expanding ideas

Related to this point, but worth drawing out separately – one of the key things that comes up over and over again is that Paul is especially brilliant at supplying people with a vision for how an idea could be orders of magnitude more ambitious, and then making them believe in themselves enough to try to do it.

He just makes these surprising connections and comes up with these surprising ideas that are things I had not thought of. Lots of investors are pretty good at the quotidian things like helping you close other deals or if you have a question of how to grant options or which lawyer to use… The conversations that are most useful with Paul are [when I am] thinking about some totally new area and I come back with 10 ideas that I had not thought of. Some of them will be really outlandish and terrible ideas and some of them are really good. Both Paul Graham and Peter Thiel have this property where they look at the world sideways and just see it slightly differently than everybody else. [Patrick Collison, via The Startup Grind]

Very few people, I think, have an energy like that. You can read about customer development online or watch Eric Ries talk or look at Dave McClure's AARRR framework for startups. That's all great. But when you have an in-person conversation with Paul, he might say some of your ideas are shitty-he might say all of your ideas are shit-but when you walk away, you want to go build something. [Justin Kan, via The Launch Pad]

Paul is the best problem solver I've ever met. He’s also a genius at expanding ideas and making radical improvements to things. One of his defining characteristics is telling people “You know what you should do...” [Jessica Livingston, Grow the Puzzle Around You]

If you’re looking for some explanation for how he does it, I don’t have one. And it seems neither does Paul, other than that he writes a lot:

Jessica: One thing I wanted to ask you about is one of your superpowers, which is just taking an idea and expanding it like 100 times bigger for founders. Where do you think that comes from?

Paul: I don't have to do the work.

Jessica: Well, I think a lot of people... I know I'm very envious. I would love to be able to do that, and most people can't do that. Where do you think it comes from?

Paul: It might be related to writing essays because when you write an essay about something, you have to really completely understand it, and so once you understand it, then you could see where it extends to get bigger. So it's just talking to them and really, really understanding the idea, and then you could see, "Oh, you could stretch this bit out and that bit out and it becomes a triangle," or something like that.

[Jessica Livingston, The Social Radars]

3. YC created a culture of mentorship beyond PG and Jessica

YC scaled this culture of mentorship beyond Paul and Jessica. While the two led YC as the only full-time team members from 2005-2009, they began to add former YC founders as part-time and full-time partners.

An important component of raising people’s ambitions is for them to be surrounded by mentors who were in their shoes previously, and had succeeded.

2010 additions:

Harj Taggar, Auctomatic W07

Paul Buchheit, the sole non-YC alum, was a world class hacker, founder, and prolific angel investor

2011 additions:

Garry Tan, Posterous S08

Sam Altman, Loopt S05

Justin Kan, Kiko S05

Emmett Shear, Kiko S05

Aaron Iba, Appjet S07

YC also does an excellent job of broadly engaging the alumni network in managing admissions. For example, Y Combinator alumni are the first readers for all Y Combinator applications, and are essentially the first filter. [Chaos Monkeys].

4. YC’s tight timelines force focus on compounding actions

In How to Do Great Work, Paul explains why it’s easy to shrink away from a big vision due to fear and modesty. It’s hard to get started. It’s discouraging to look at your progress relative to your goal. But then, he gives a solution: Focus on consistently doing small things that compound.

Great work happens by focusing consistently on something you're genuinely interested in. When you pause to take stock, you're surprised how far you've come.

The reason we're surprised is that we underestimate the cumulative effect of work. Writing a page a day doesn't sound like much, but if you do it every day you'll write a book a year. That's the key: consistency. People who do great things don't get a lot done every day. They get something done, rather than nothing.

If you do work that compounds, you'll get exponential growth.

In YC, this is the only kind of work you can do. The program lasts only 3 months, and you must have something to demo at Demo Day. Therefore, you must have something built and launched sooner than that. Also, you have to build the idea with a small amount of capital. When YC launched, the amount of funding was $6000 ✕ n, where n is the number of founders.

From Startup = Growth:

During Y Combinator we measure growth rate per week, partly because there is so little time before Demo Day, and partly because startups early on need frequent feedback from their users to tweak what they're doing. A good growth rate during YC is 5-7% a week. If you can hit 10% a week you're doing exceptionally well. If you can only manage 1%, it's a sign you haven't yet figured out what you're doing.

We usually advise startups to pick a growth rate they think they can hit, and then just try to hit it every week. The key word here is "just." If they decide to grow at 7% a week and they hit that number, they're successful for that week. There's nothing more they need to do. But if they don't hit it, they've failed in the only thing that mattered, and should be correspondingly alarmed. Programmers will recognize what we're doing here. We're turning starting a startup into an optimization problem.

In theory this sort of hill-climbing could get a startup into trouble. They could end up on a local maximum. But in practice that never happens. Having to hit a growth number every week forces founders to act, and acting versus not acting is the high bit of succeeding. Nine times out of ten, sitting around strategizing is just a form of procrastination.

Also, all you are really committing is a summer. Who wouldn’t try for 3 months, just to see if they can get something going?

5. Tech’s measurability makes for healthy competition

A corollary to the focus on compounding growth of revenue or users is that most of the startups in YC could be compared by the same metric. Paul even specified that “good” during YC is 5-7% w/w growth. In theory, while not explicitly competing, every startup in the batch could know where they sit in the ranking relative to their peers.

Competition with peers also helps overcome the fear and modesty that limit ambition. It’s much easier to focus on growing faster than your batchmates than trying to build the next Stripe.

A consistent pattern across historical examples of great work in many fields – art, science, writing, philosophy, etc – is that it is rarely done in isolation. Instead, great work originates in collaborative circles of friends experimenting together and challenging one another. Consider the quantum physics community of the 1920’s. Or in art and literature, the French Impressionists, or C. S. Lewis, J. R. R. Tolkien, and the Inklings.

Even though YC startups range widely in their products, the ability to reduce ideas down to core metrics produces some of the conditions necessary for these collaborative circles to form.

It’s worth pausing to note that an obvious error mode in this structure is that if the startups can’t compete on growth rate, they will start to compete on proxies like fundraising and headcount. The further the proxy gets from the goal, the more the value of the competition deteriorates. This is something to be extremely careful about when applying this concept to other fields.

Conclusion

Just five months after launching YC, in October 2005, Paul remarked “the hypothesis we were testing seems to be correct. Young hackers can start viable companies. This is good news for two reasons: (a) it's an encouraging thought, and (b) it means that Y Combinator, which is predicated on the idea, is not hosed.” There wasn’t just one random success from the first batch, either; he estimated that 3-4 of the startups would make it. But he probably didn’t predict that one would become one of the most popular websites in the world!

YC scaled really fast. The second batch launched only half a year later. Just 2 years later, YC had already backed 50 more companies across four batches – W06, S06, W07, and S07.

By my count, 12 of these 50 were hits, an insane 24% hit rate.

YC has now invested in 4000 companies worth $600B combined. Counted among those 4000 are some of the most valuable and impactful startups ever, including AirBnB, Stripe, Instacart, Coinbase, Doordash, and Reddit. Moreover, YC bought 5-7% of these companies for <$20,000 each! And that’s not counting the subsequent startups to come from YC founders, like OpenAI (where Jessica was one of the first funders).

And all of this was started from $2M of personal capital from Paul, Jessica, Trevor, and Robert. YC didn’t take any outside money until 2009, 4 years after starting.

The “relatively small amount of force applied at just the right place” has been spectacularly effective.

There is still lots more work to understand about this question. I hope that with this essay, more people will become obsessed with this question as I am, and we will see many more experiments to figure it out, both in startups and in new fields.

If you’re looking for more, Eric Gilliam wrote a fantastic accompanying piece about applying the lessons of YC to a new model for Deep Tech investing. If you don’t already read Freak Takes, I also highly recommend his study of Warren Weaver and how he cultivated the field of molecular biology.

Also consider subscribing below. You might like this review of Tyler Cowen and Emergent Ventures for more on this topic.

Notes

[1] The attentive reader might notice the author of this website.

[2] For good analysis on YC in more recent years, there is a good review from The Generalist.

[3] I use the word “hacker” throughout this essay in a manner consistent with Paul’s definition: “To the popular press, "hacker" means someone who breaks into computers. Among programmers it means a good programmer. But the two meanings are connected. To programmers, "hacker" connotes mastery in the most literal sense: someone who can make a computer do what he wants—whether the computer wants to or not.” [Paul Graham, The Word “Hacker”]

[4] Annotated history of Hacker News traffic.

[5] pg: “This just freaks me out.”

[6] Trevor Blackwell writes: “PG has talked about not starting your startup in co-working spaces, because the startup will take on the ambient culture instead of developing its own, and the ambient culture in co-working spaces is pretty bogus. But living with and being friends with fellow founders is great. Being a founder can be lonely, because there are parts of the struggle you can't share with the rest of the company. Being friends with people going through the same process is one of the best things you can do for the company and yourself.”

[7] Sam Altman’s advice to AirBnB founders: “Take all the M[illion]s and make them B[illion]s. Either you don’t believe everything you said in the rest of the deck, or you’re ashamed, or I can’t do math.” This strongly echoes of Paul’s comment about fear and modesty.

Acknowledgements

Thanks to Sam Arbesman, Alex Wolf, Nicole Ruiz, Dwarkesh Patel, Sam Rodriques, Eric Gilliam, Michael Retchin, and several YC founders for comments and discussions. Special thanks to Alexey Guzey and Niko McCarty for helpful encouragement and revisions.

Going through the grapevine of references, from your essay, and reading your earlier Tyler Cowen profile - lots of paths to follow in and out.

I came across Paul Graham's essay on Earnestness (http://www.paulgraham.com/earnest.html). All quotable! But what intrigued me most is this quote:

"In his (wonderful) autobiography, Paul Halmos says explicitly that for a mathematician, math must come before anything else, including family."

How was Paul Graham reading a mathematician's autobiography? Was he just reading widely - or was he actually embedded at some point, somehow, in the world of math?